On Philanthropy: Emancipation from itemization? So long, charitable conversation

Contributed by AFP SEWI

Contributed by AFP SEWI

Milwaukee Business Journal

September 22, 2017 issue

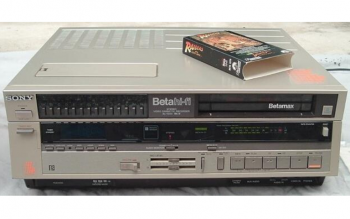

As my wife will tell you, I hate to give up something of value -- even if I seldom use it. (Hey, my Betamax could still make a comeback, right?).

Financial advisors: are you like me? Because you might soon lose something of potential value – though data indicate you’re not using it anyway.

If Paul Ryan’s tax reform blueprint doubles or triples the standard deduction, studies suggest only 5 percent of taxpayers would continue to itemize their returns. Without itemizing, they couldn’t claim deductions for charitable contributions.

If the tax advantage of giving dries up, here’s what you personally lose: your opportunity to use philanthropic conversations to deepen client relationships.

Data says advisors don’t maximize this opportunity. More than 98 percent of high net worth individuals contribute, and do so because they’re passionate about causes. Charity’s tax advantages provide a natural entre to draw your client out about their passions – the kind of conversation that cements business relationships.

Surveys say high net worth individuals want those conversations and are more likely to choose advisors interested in their philanthropy. Yet those surveyed report that advisors initiate a mere 17 percent of philanthropic conversations, then stick mostly to the technical aspects.

Sigh. The tax deduction has great potential value for you and your business. Will you care if it’s boxed with my Betamax?

When a neglected valuable is threatened, it’s human nature to either rationalize its loss or rediscover its value. Your clients hope you take the latter approach – and your business will prosper for it.

AFP’s monthly On Philanthropy column is contributed monthly by Doug Diefenbach for the Association of Fundraising Professionals, Southeastern Wisconsin Chapter. Please contribute ideas for future articles here.